Justice Alito sees 'no sound reason' to recuse in tax case involving lawyer who interviewed him for newspaper

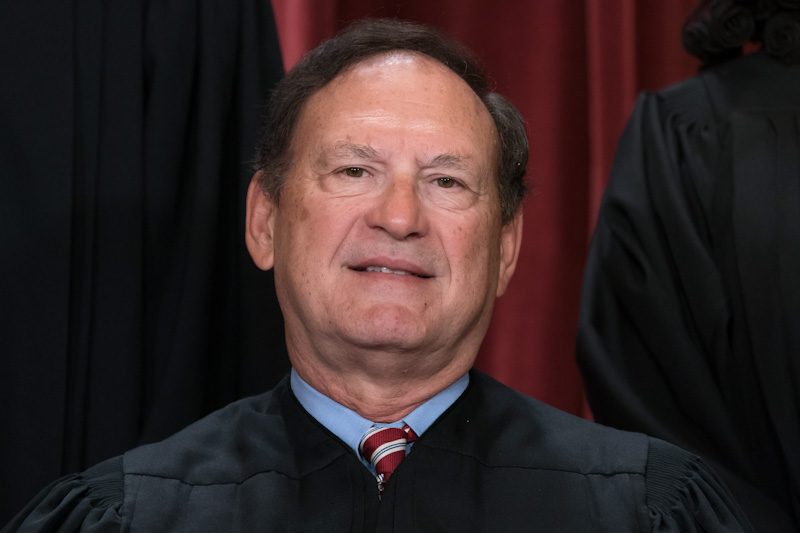

U.S. Supreme Court Justice Samuel Alito said in a Sept. 8 statement there is “no sound reason” for his recusal in a tax case handled partly by a lawyer whose co-interviews resulted in two articles in the Wall Street Journal. Photo by J. Scott Applewhite/The Associated Press.

U.S. Supreme Court Justice Samuel Alito on Friday refused to recuse himself in a tax case handled partly by a lawyer whose co-interviews of the justice resulted in two articles in the Wall Street Journal.

Alito said in a Sept. 8 statement there is “no sound reason” for his recusal. Justices are able to put aside personal connections to attorneys who appear before them or to attorneys who have expressed views of the justices, he said.

Senate Judiciary Committee Chairman Dick Durbin, a Democrat in Illinois, had urged Chief Justice John Roberts to take appropriate steps to ensure that Alito recuse himself in the case because it is being handled partly by lawyer David B. Rivkin Jr.

Alito said Rivkin was acting as “a journalist, not an advocate” when he interviewed Alito and co-authored the articles.

“The case in which he is involved was never mentioned; nor did we discuss any issue in that case either directly or indirectly. His involvement in the case was disclosed in the second article, and therefore readers could take that into account,” Alito said.

Alito said Rivkin is an “opinion-journalist” who has published hundreds of articles, op-eds and book reviews.

Reuters, Bloomberg Law and Law360 are among the publications with coverage.

Rivkin had participated in the interviews and co-authored the two stories with Wall Street Journal writer and editor James Taranto. In one of the stories, Alito said he didn’t think that Congress had the authority to bind the Supreme Court on ethics issues.

Alito said there was nothing out of the ordinary about the interviews.

“Many of my colleagues have been interviewed by attorneys who have also practiced in this court, and some have co-authored books with such attorneys. Those interviews did not result in or require recusal,” Alito said.

Alito also said the Supreme Court is often presented with cases in which one of the lawyers has spoken favorably or unfavorably about the justices’ work or character. And the justices also see cases in which one of the lawyers is a former law clerk, a former colleague or a longtime acquaintance.

“If we recused in such cases, we would regularly have less than a full bench, and the court’s work would be substantially disrupted and distorted,” Alito said.

Rivkin, a partner at Baker & Hostetler, is among the lawyers representing two taxpayers who argue that gains must be realized before they can be taxed.

The taxpayers, Charles and Kathleen Moore, were minority owners with no role in management of a company that sells affordable farming equipment in India, according to the cert petition. They never received distributions, dividends or other payments on their $40,000 investment. But they were nonetheless taxed on the company’s reinvested earnings under the Mandatory Repatriation Tax.

The cert petition cited an article by the Wall Street Journal that described the tax as a “wealth tax.” The law at issue targets shareholders who own 10% or more of foreign corporations that are primarily owned or controlled by U.S. citizens.

The case is Moore v. United States.

See also:

“No summer break for Supreme Court ethics debate”

“ABA task force recommends ethics and transparency changes for Supreme Court”

“Supreme Court justices should follow binding code of ethics, ABA House says”